Table of Content

You can follow the tips given below to improve your eligibility for a home loan. Specifications which the underlying property such as age of the property, its size, etc. Click ‘View Application’ below the one whose status you wish to check. 3) Enter your name, user ID, mobile number and other required details to sign up. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums.

CreditMantri was created to help you take charge of your credit health and help you make better borrowing decisions. If you are looking for credit, we will make sure you find it, and ensure that it is the best possible match for you. We enable you to obtain your credit score instantly, online, real time. We get your Credit Score online and provide a free Credit Health Analysis of your Equifax report.

Eligibility for HDFC Home Loan for Women

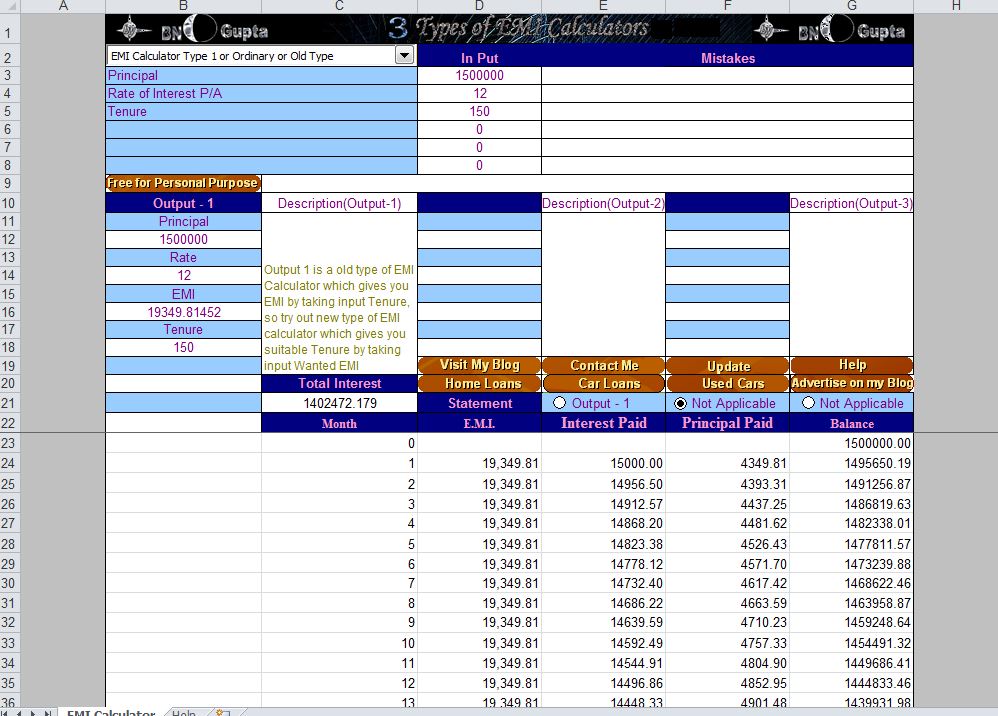

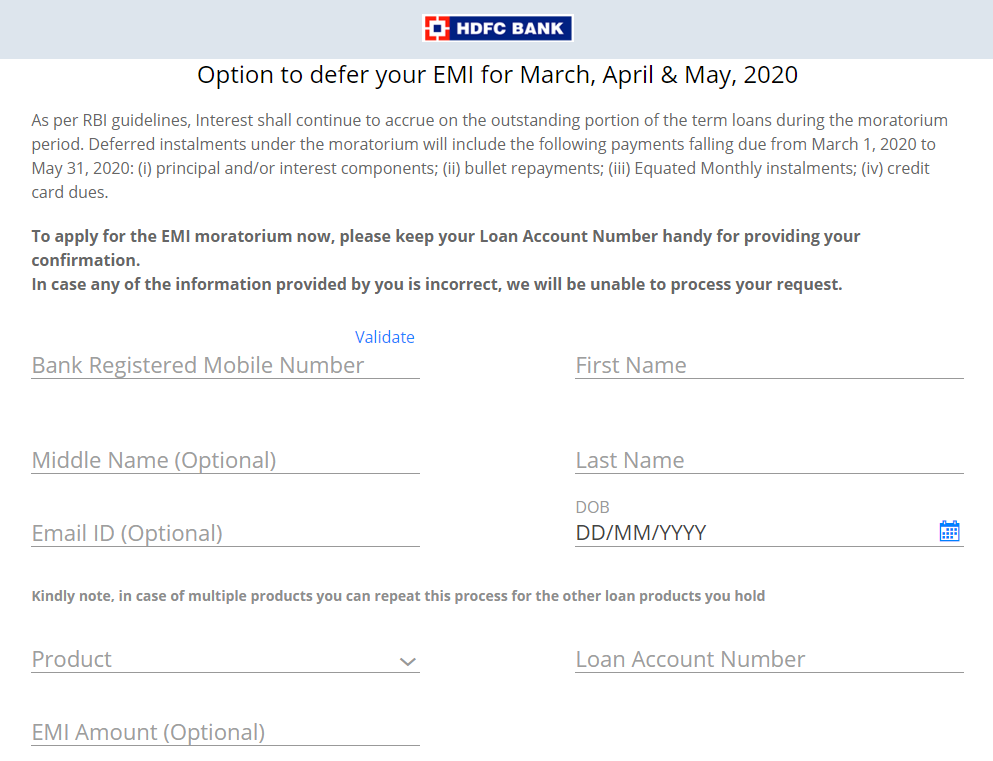

The loan EMIs remain uniform throughout the tenure of the home loan. Also, the amount paid as EMIs is credited towards the principal amount of the loan and interest charged on it. Generally, the initial instalments contribute towards the interest amount. Home loan eligibility calculator gives an accurate estimate of the Home Loan that you can borrow from HDFC. HDFC Sales website also allows you to apply for a Home Loan online, even if you have not finalized the property.

All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan. The subsidy amount under the scheme largely depends on the category of income that a customer belongs to and the size of the property unit being financed. You can submit a request for the disbursement of your loan online or by visiting any of our offices. Loans against property / Home Equity Loan for Business Purpose i.e.

It helps you avail funds for home purchase

It will redirect the website containing the loan calculator to you. Scheduling for a company representative to visit at a suitable time. The borrower must be a salaried worker with a reputable company.

The maximum repayment tenure depends on the type of housing loans you are availing, your profile, age, maturity of loan etc. HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure. HDFC’s end-to-end digital home loan application process, integrated branch network across the county and 24X7 online assistance can make your home owning journey a memorable one. The borrower needs to either apply online or directly download the application form from the official website or visit the nearest bank branch.

EMI Payable

3) Enter the required personal, professional, income, property-related details, and upload necessary documents. To be eligible for an HDFC Home Loan, your application needs to be supported by the right documents. Co-ordinate with the lender to make sure you submit all the necessary documents. Below is a basic list of Home Loan documents required by the bank.

Loan Amount – This amount borrowed from HDFC for a home loan by a borrower affects his home loan EMI. With HDFC, you can get a home loan for a minimum of Rs. 5 lakhs up to Rs. 5 crores. It will also show the total amount paid towards the principal, the interest amount charged, and the total amount payable towards the loan. Make sure you provide all the details that the home loan provider will need to process your application. Complete the application form online with the necessary information.

From a very young age people start thinking about their home – how they want it to look what are things they will have in the house etc. But as they grow up they realize that to make their dream come true they need money which is not easy to save with the current economy and inflation. It is to help people buy their dream homes that banks and NBFCs offer home loans.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Here’s how you can check the status of your Home Loan application on the HDFC website. 4) Enter all the required details and upload documents as required. We are unable to show you any offers currently as your current EMIs amount is very high.

After entering the necessary details, the calculator automatically calculates the loan EMI amount to be paid and delivers the result on the same page. It takes less than a minute to check the EMI amount against the home loan to be taken. You might have a loan amount, interest rate and tenure in mind but might be surprised at the EMI that you have to pay once you calculate it. Therefore, you need to use HDFC Bank’s EMI calculator to help you choose the right loan amount, interest rate and tenure that you are comfortable with.

This is the primary home loan offered by the bank to purchase a new property, resale property, or construct a new home. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement. Post the fixed rate tenure, the loan switches to an adjustable rate.

Before applying for a home loan, one must check his/her eligibility to get the same. Home loan eligibility constitutes certain criteria that a borrower needs to fulfil when applying. Home Loan eligibility evaluates the credit-worthiness of the borrower to repay the amount taken as a home loan as per the payment schedule and without any default. Will HDFC Ltd. approve a home loan before I decide which property I should purchase? The loan amount you will be eligible for based on your salary has been mentioned in the table below.

No comments:

Post a Comment